By ratifying the Paris Agreement on climate change, Switzerland has committed itself to align finance flows with the climate goal (Art. 2 (1) c)). The question of which strategies and actions financial markets actors can use for an effective contribute to reach this goal, is becoming increasingly important for private actors as well as environmental and financial regulators. The financial market actors approach this issue differently.

With sustainable investments, investors want to support the achievement of environmental and sustainability goals. The most widely used approach today is the integration of environmental, social and governance criteria into investment decisions, the so-called ESG integration. In a study, FOEN analysed how effective this approach actually is. The disillusioning conclusion is: «maybe a little bit». The results show, that many individual decisions can add up to a larger effect. Overall, however, today's ESG approaches lead to little sustainable change, especially due to the metrics used.

Does ESG integration impact the real economy? (PDF, 1 MB, 01.06.2022)Study commissioned by FOEN (in English, summary in German and French)

In December 2022, the Federal Council published its position with regard to the prevention of greenwashing in the financial sector. Financial products or services should only be advertised as being sustainable if they are compatible with at least one specific sustainability goal or contribute to achieving a sustainability goal. This should ensure that financial products and services that are aimed at reducing ESG risks are labelled as sustainable only if they pursue a sustainable investment goal in addition to a purely financial one.

A study examines this sustainability of pillar 3a products. In addition, it proposes a concept for determining the financial and sustainability-related goals of customers in an integrated manner.

Nachhaltigkeit in der Säule 3a (PDF, 2 MB, 23.01.2024)Im Auftrag des BAFU

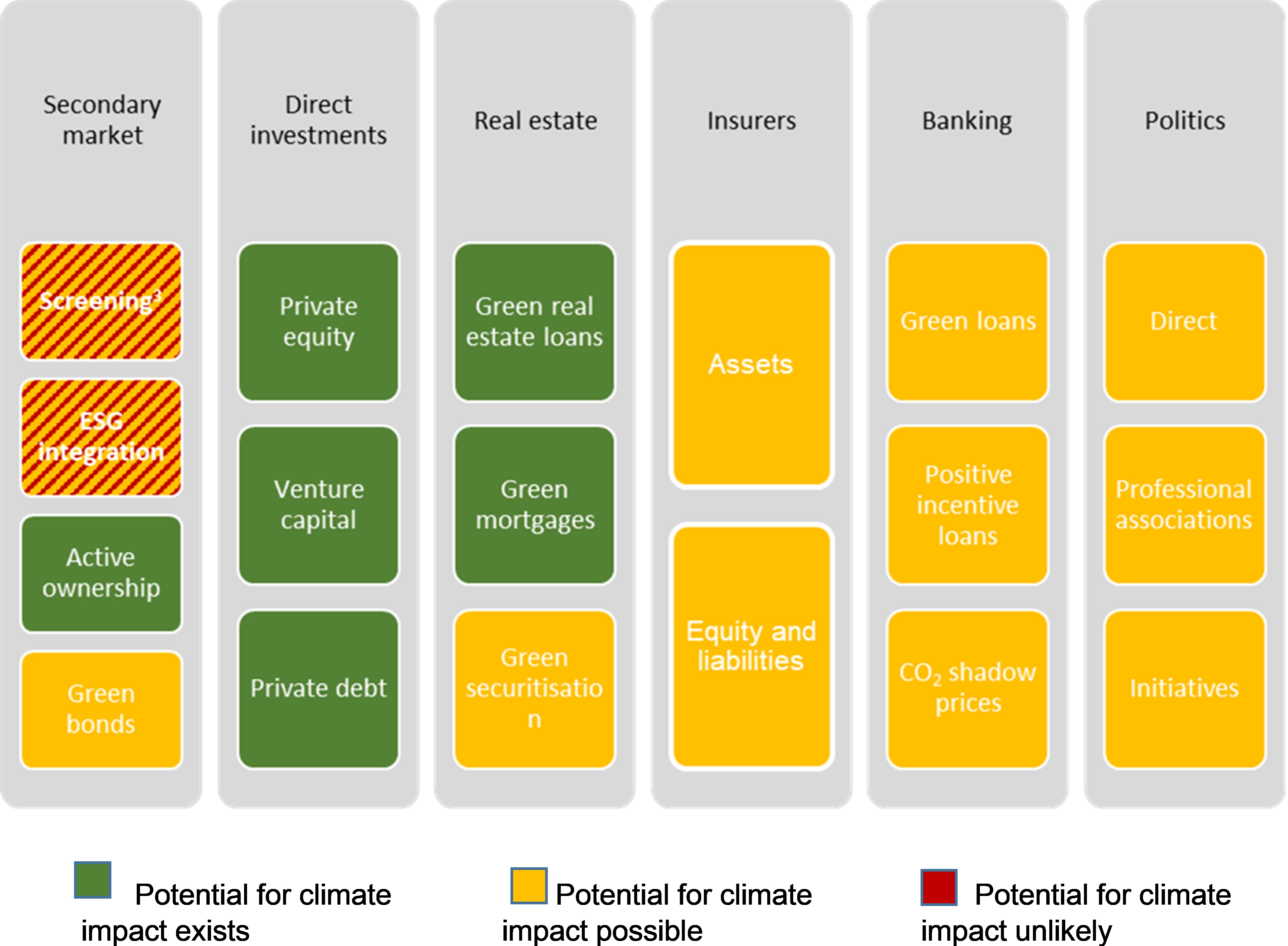

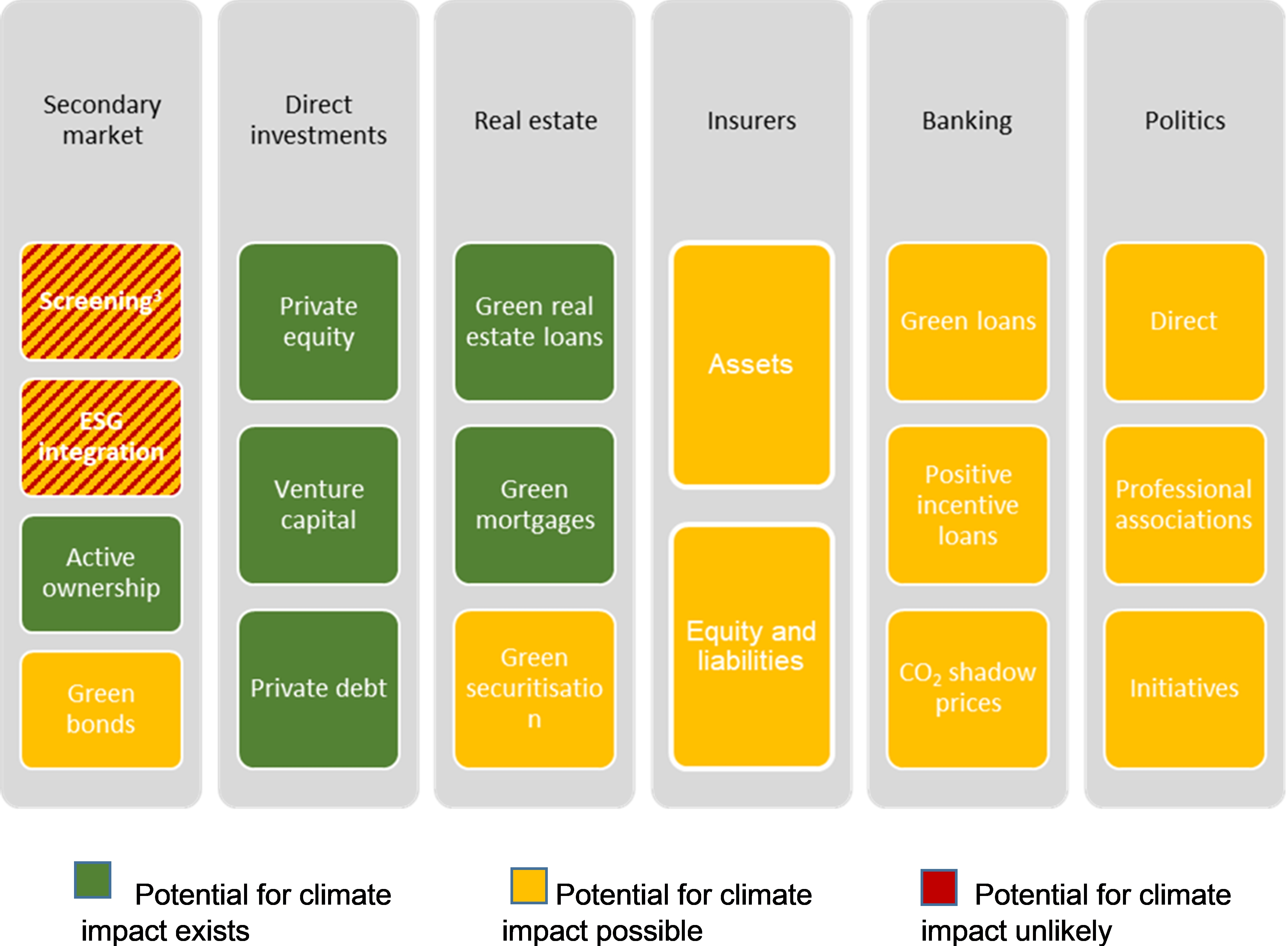

In addition, a broad literature study commissioned by the FOEN discusses the theoretically available channels of action and analyses which conditions must be met for actions taken by financial market actors to have a climate impact. Impact should be understood here as a climate-relevant change in companies in the real economy. The study shows that the extent to which a climate impact can be achieved is highly dependent of the concrete implementation of the action.

Here you will find the executive summary on the overview of the climate impact of measures taken by financial market players in English. The summary is also available in German and French, the whole study only in German.

Überblick zur Klimawirkung durch Massnahmen von Finanzmarktakteuren (PDF, 2 MB, 30.11.2020)Studie im Auftrag des BAFU

Executive Summary: Overview of the climate impact of financial market players’ action (PDF, 350 kB, 07.12.2020)Study on behalf of the FOEN

Overview of the current research regarding the climate impact of financial market actors’ actions

Risks associated with current investment behaviour

Climate impacts such as flooding and heat waves can affect property values (physical climate risks). In the event of global warming of 4 to 6 °C, the projected value lost is much greater than if warming is successfully contained below the critical threshold of 2 °C compared with pre-industrial levels. If measures are taken around the world (e.g. a CO2 levy) to limit fossil fuel use or directly make fossil fuels more expensive, the affected companies can lose value (transition risks). Climate-friendly investment strategies can reduce these risks while achieving returns in line with the market.

A number of supervisors and central banks came together in late 2017 to form the Network for Greening the Financial System (NGFS). The Swiss National Bank (SNB) and Swiss Financial Market Supervisory Authority (FINMA) are among the members. The aim is to exchange experiences with climate risks on a voluntary basis and contribute to the development of climate risk management in the financial sector. In order to recognise such risks at institutional level at an early stage, an expert group called TCFD, led by the industry and set up by the Financial Stability Board, recommends a number of measures, including 2 °C scenario analyses. By participating in the climate impact tests, a large number of Swiss financial market actors have implemented this recommendation for the first time.

A legal opinion commissioned by the FOEN shows that material climate risks already have to be taken into account to a large extent in current law. On a voluntary basis, climate impacts resulting from investment and financing decisions can also be measured and reported.

Rechtliches Gutachten «Berücksichtigung von Klimarisiken und -wirkungen auf dem Finanzmarkt» (PDF, 513 kB, 31.10.2019)Gutachten von Prof. Dr. Mirjam Eggen, Bern und Dr. Cornelia Stengel, Zürich, im Auftrag des BAFU, 2019.

Last modification 26.01.2024